Paycheck and overtime calculator

Time and attendance software with project tracking to help you be more efficient. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

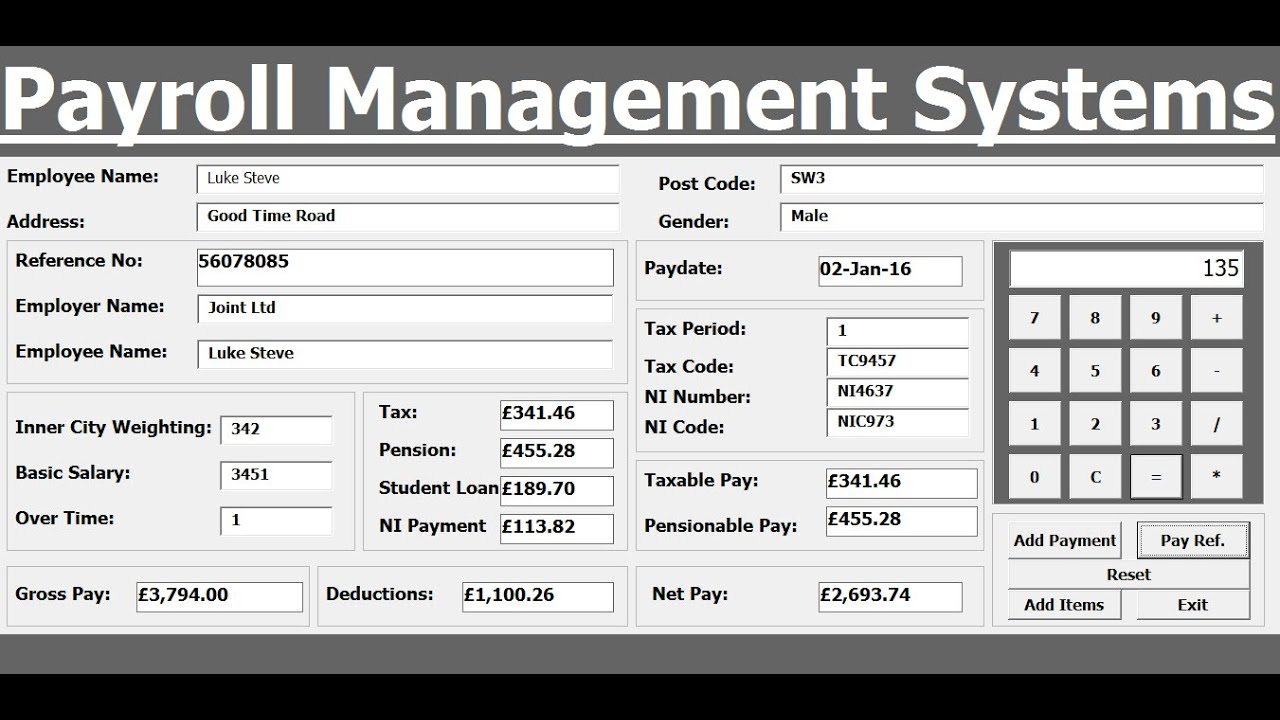

How To Create Payroll Management Systems In Excel Using Vba Youtube Management Payroll Excel

Time and attendance software with project tracking to help you be more efficient.

. All Services Backed by Tax Guarantee. We use the most recent and accurate information. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

If you want a. Ad Create professional looking paystubs. This free hourly and salary paycheck calculator can estimate an employees net pay based on their taxes and withholdings.

Pay rates include straight time time and a half double time and triple time. Ad Create professional looking paystubs. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

- standard hourly pay rate 20 - overtime hours worked 30 - overtime pay rate 30 - double time hours 5 - double time pay rate 40 and a one time bonus of 100 will result in these. Get an accurate picture of the employees gross pay including. To try it out enter the.

Subtract any deductions and. In a few easy steps you can create your own paystubs and have them sent to your email. Overtime hours worked and pay period both optional.

Heres a step-by-step guide to walk you through. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Hourly Paycheck Calculator Use this calculator to help you determine your paycheck for hourly wages.

Ad No more forgotten entries inaccurate payroll or broken hearts. 1200 40 hours 30 regular rate of pay 30 x 15 45 overtime. Free salary hourly and more paycheck calculators.

We use the most recent and accurate information. First enter your current payroll information and deductions. Then enter the hours you.

- Or can be a quadruple time which is normal pay rate multiplied by 4 or even a customizable value by case Other. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Ad Payroll So Easy You Can Set It Up Run It Yourself.

The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. This number is the gross pay per pay period. In a few easy steps you can create your own paystubs and have them sent to your email.

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal state and local income tax withholding. California overtime law requires employers to pay nonexempt employees who are 18 years of age or older for overtime hours worked. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

On the state level you can claim allowances for Illinois state income taxes on Form IL-W-4. The overtime calculator uses the following formulae. The calculator includes rates for regular time and overtime.

For employees who are between 16-17 years of age and. Ad No more forgotten entries inaccurate payroll or broken hearts. Exempt means the employee does not receive overtime pay.

It can also be used to help fill steps 3 and 4 of a W-4 form. Over Time Paycheck Calculator Overtime Calculator Usage Instructions Enter your normal houlry rate how many hours hou work each pay period your overtime multiplier. In addition a rate of nothing is included for people who.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Your employer will withhold money from each of.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Next divide this number from the annual salary.

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Excel Templates Tax Credits Federal Income Tax

Payslip Templates 28 Free Printable Excel Word Formats Templates Excel Templates Contract Template

Employee Training Schedule Template Excel Elegant Yearly Training Plan Template Excel Free Weekly Schedule Excel Templates Excel Calendar Employee Training

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Payroll Calculator Template Free Payroll Template Payroll Templates

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Video Video Budgeting Budget Spreadsheet Monthly Budget Template

Biweekly Timesheet With Sick Leave And Vacation Payroll Office Templates Timesheet Template

Weekly Time Record Time Sheet Printable Sign In Sheet Template Attendance Sheet Template

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Video Video Budgeting Budget Spreadsheet Monthly Budget Template

Pin On Payroll

Self Employment Ledger Forms Inspirational Self Employment Ledger Template 13 Trust Account Ledger Bookkeeping Templates Payroll Payroll Template

Payslip Template Blue Life Hacks Websites Payroll Software Templates

Free Timesheet Template For Excel Timesheet Template Templates Printable Free Payroll Template

3 334 Cash Unstuffing I Got Monetized Youtube Budget Planner Sale Cash Stuffing Youtube Budgeting Planner Coding

Calculating Your Paycheck Salary Worksheet 1 Answer Key Fill Out And Sign Printable Pdf Template Signnow Paycheck Teaching Math Printable Signs

Bi Weekly Budget Spreadsheet Paycheck To Paycheck Budget Etsy Video Video Budgeting Budget Spreadsheet Monthly Budget Template

23 Employee Timesheet Templates Free Sample Example Format Download Timesheet Template Templates Printable Free Home Health Aide