How much can i borrow with 50000 deposit

A good credit history can make it easier for you to borrow money while a bad credit history or no credit history can make getting loans for things like cell phones credit cards and housing more difficult. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2620000.

How Much Can I Borrow Depending On My Deposit Mozo

Open new eligible Citi Priority checking account during the offer period from July 18 2022 through Jan.

:max_bytes(150000):strip_icc():gifv()/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

. You can also input your spouses income if you intend to obtain a joint application for the mortgage. The LTV is also used to determine how much you can borrow. 6 to 30 characters long.

If a landlord fails to protect your deposit you can go to the small claims court which can order the landlord to either repay the deposit to you or pay it into a deposit protection scheme if youre still in your tenancy within 14 daysIt may also order the landlord to pay you a penalty of up to three times the value of your deposit within 14 days. For a limited time a checking account bonus worth up to 2000 when you open a Citi Priority Account and complete all required activities. Explore more mortgage calculators.

If you do plan to borrow first check with your own bank as cheap rates for such large borrowing are often for existing customers only. Gross monthly income is total income from all sources before taxes. Check what your monthly repayments are likely to be.

Included are a few places to refinance or find a great mortgage rate. The amount you can personally borrow will. Plans are not required to include this exception.

Make a qualifying deposit of funds new to Citi between the checking and savings accounts within 20. Be VERY sure you can repay it. You can also get a sense of your savings target by age by looking at recent data from the Bureau of Labor Statistics BLS.

Fixed rates from 799 APR to 2343 APR APR reflect the 025 autopay discount and. No minimum deposit and all deposits. For example if a participant has an account balance of 40000 the maximum amount that he or she can borrow from the account is 20000.

This article provides a proper framework for 529 plan contributions by age. It will also increase the number of lenders available to you which means a better chance of landing the mortgage you need. I take 1000000 x 5 income produced from nest egg and get 50000.

In such case the participant may borrow up to 10000. Certain lenders offer personal loans up to 50000 though its a huge commitment so think very carefully before getting such a large amount. If the value of your crypto collateral is 10000 and the LTV is 70 then you can borrow 10000 x 70 or 7000 against your crypto assets.

That was a crazy figure for this reason. The idea is to contribute enough so that the 529 plan can comfortable cover most if not all of your childs college expenses when the time comes. An exception to this limit is if 50 of the vested account balance is less than 10000.

So if you make 50000 per year your gross monthly income would be around 4167. Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Wondering how much to contribute to a 529 plan.

The stock market has historically risen an average of 10 percent annually over long periods but it has proven to be quite volatile. 40000 loans - 50000 loans - 12 month loans - 10 year loans - Long term loans - Long. 2 Scotiabank cannot accept more than one wire payment per family and such payment cannot exceed CAD 50000.

Youve estimated your affordability now get pre-qualified by a lender to find out just how much you can borrow. Stocks offer the potential for much higher returns. My goal for early retirement is a nest egg of 1000000.

Margin accounts allow a brokerage customer to borrow money to invest in securities. The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000. Our guide explains more.

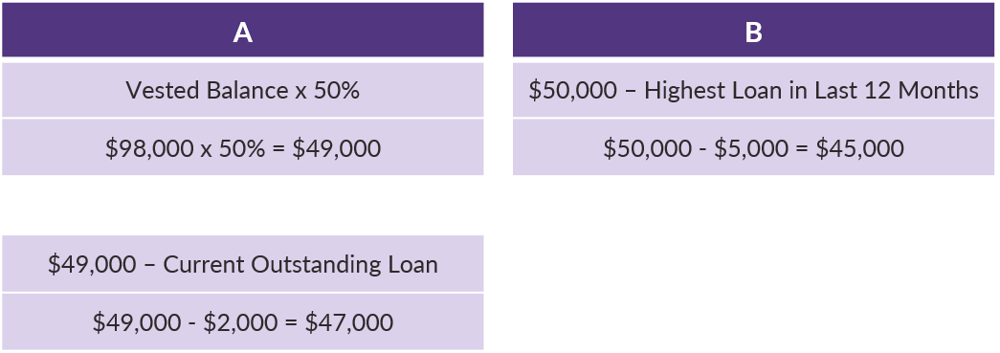

You should try to work out how much you can afford to borrow and pay back before applying for a loan. The maximum amount a participant may borrow from his or her plan is 50 of his or her vested account balance or 50000 whichever is less. The maximum amount you can borrow on a car finance deal is 36000 or 50000 with a personal loan.

The BLS data show average annual income and expenditures by age and type. For background I am a father of two young children. How much can I borrow.

ASCII characters only characters found on a standard US keyboard. For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. HP is a form of car finance where you pay a deposit and monthly instalments for a fixed term before you own the vehicle.

You can use the above calculator to estimate how much you can borrow based on your salary. My plan is to retire in 10 years at 42. You may think you can afford a 300000 home but lenders may think youre only good for 200000 based on factors like how much other debt you have your monthly income and how long youve.

Must contain at least 4 different symbols. Hire purchase starts with a deposit to hire the car usually around 10 of the cars value. Lets presume you and your spouse have a combined total annual salary of 102200.

Both of their plans were superfunded the. So if you deposit 25 on a home that would mean the LTV is 75. Five simple calculations that can tell you in seconds how much house you can afford.

The maximum amount that the plan can permit as a loan is 1 the greater of 10000 or 50 of your vested account balance or 2 50000 whichever is less. PNCs HELOC lets you borrow up to 849 percent of your homes value and you can get a discount on your rate if you set up automatic payments from a PNC checking account. The funds or equity in the brokerage account are often used as collateral for this loan.

Latest news on economy inflation micro economy macro economy government policy government spending fiscal deficit trade trade agreement tax policy indian. If the LTV goes above that set by the lending platform during the term of the loan due to a decrease in the value of the collateral the borrower. Provide a 15 deposit 30k youll need to borrow.

I take 50000 and subtract 15 the IRS cut and get 42500. If youre looking to maximise how much you can borrow however a larger deposit can go a long way towards persuading lenders that youre a safe bet. I just calculated how much I spent last year.

:max_bytes(150000):strip_icc():gifv()/Compoundinterest-f0b145415f244b40bb93c82154e8343d.png)

Compound Interest Explained With Calculations And Examples

How Much Can I Borrow Depending On My Deposit Mozo

Home Affordability Calculator Credit Karma

Will A Mortgage Lender Check Where A Deposit Has Come From Sterling Money Pound Sterling Money Notes

/interestrates-28359fec035e44b1a1e52b3a026d3baf.png)

Interest Rates Different Types And What They Mean To Borrowers

How Much Can I Borrow Depending On My Deposit Mozo

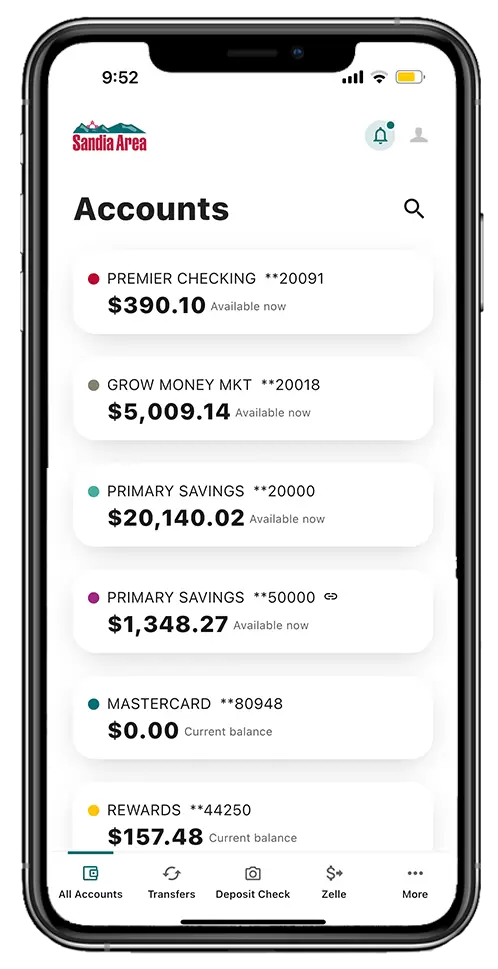

Online Mobile Banking Changes Sandia Area Federal Credit Union

Compound Interest Calculator With Formula

How Do I Calculate How Much Money Is Available For A 401 K Loan

Example Of A Property With A Good Cash Flow Return Green Label Positive Cash Flow Cash Flow Statement Cash Flow

How Much Can I Borrow Depending On My Deposit Mozo

4 Personal Loan Lenders That Ll Give You As Much As 50 000

Direct Deposit Loans And 11 Quick Cash Alternatives Fox Business

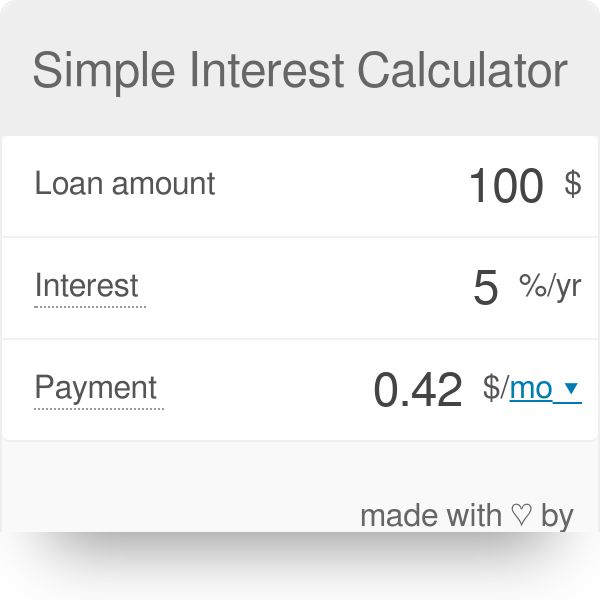

Simple Interest Calculator Defintion Formula

:max_bytes(150000):strip_icc()/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Reserve Ratio Definition

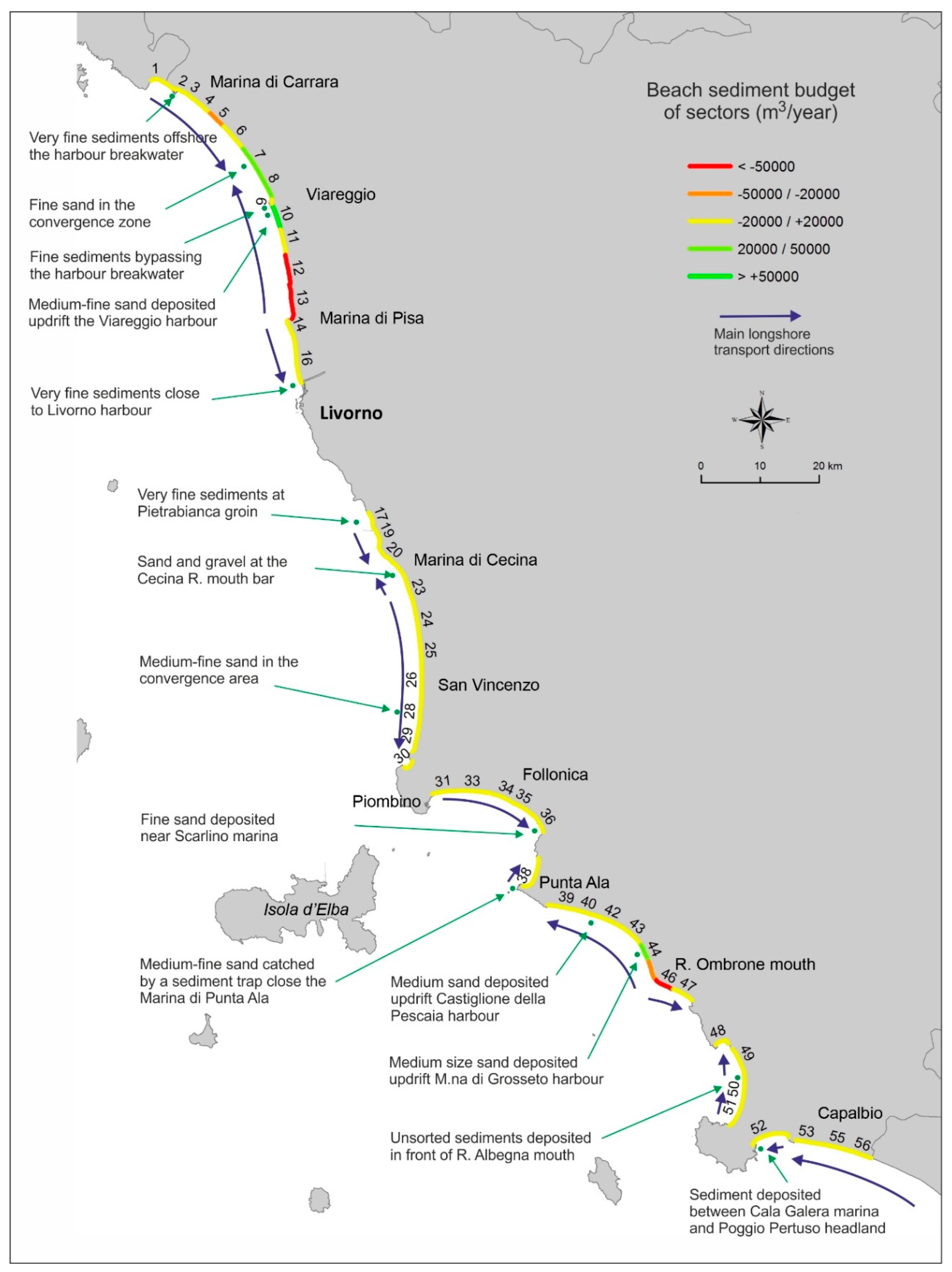

Jmse Free Full Text An Integrated Coastal Sediment Management Plan The Example Of The Tuscany Region Italy Html

How To Get A 50 000 Personal Loan Bankrate